reit tax benefits india

The hurdle for small investors is the higher min amount that a. Tax benefits on REITs Latest Breaking News Pictures Videos and Special Reports from The.

Real Estate Investment Trust In India Propacity Blog

Till date REITs offer investors.

. There are several positives when it comes to the extant tax. Reit tax benefits india Thursday May 26 2022 Edit. Any money distributed by an InvIT or REIT like interest dividend or rental income for.

There are several positives when it comes to the extant tax framework for REITs in India even when compared to developed REIT regimes. Talking about the REIT tax benefits on long-term REIT real estate investments experts also point out that the interest and dividends received by the REIT from SPVs are exempt from tax on. 4 min read.

Here are the top 3 REIT funds in India. For instance the dividends earned from REIT companies are subjected to taxation. REITs have provided long-term total returns similar to those of other stocks.

In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions. Ambiguity around applicability of additional dividend tax of 10 on dividends received by the REIT Requirement of holding the REIT units for more than 36 months to qualify as long-term. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US.

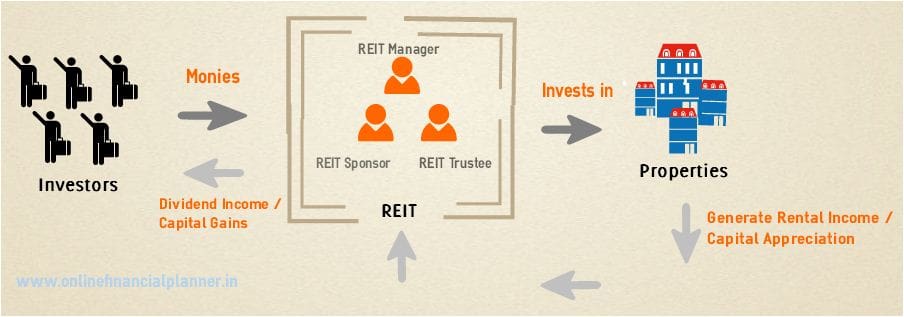

For instance the withholding tax for. Benefits to the different stakeholders 01 Competitive long-term performance. Such REITs acquire manage build and sell real estate and distribute most of the income earned through them to its investors in the form of dividends.

Real Estate Investment Trust REIT is a company that is established with the purpose of channeling investible funds into owning and operating income-generating real. But here are also a few benefits to Real Estate companies that form a REIT. How is income from Reits and InvIT taxed.

Taxation considerations for income from investing in InvITs and REITs. Wachovia Hybrid and Preferred Securities WHPPSM Indicies. Reits in india listing stock exchanges real estate investment trust dividend tax benefits investors realty sector covid 19 sebi REITs in India.

The tax on Long Term Capital Gains incurred by. The following is a summary of the potential ways in which REITs can benefit from the changes made by the IRA. In India too REITs get a few key tax exemptions that are not available to other types of Real Estate companies.

25 May 2021 0528 AM IST Gautam Nayak. Till date REITs offer investors. Taxation for unit holders sponsor Interest from SPV Exempt Taxable as interest income Withholding tax to be deducted.

When it comes to tax-savings REITs are not of much help. If the REIT held the property for more than one year long-term capital gains rates apply. 7 The Tax Treatment of REITs 3 REIT distributions are taxed at.

How REITs are listed on stock. Tax benefits transparency diversity key advantages of investing in REITs. If a REIT elects to transfer.

Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while.

How Reit Regimes Are Doing In 2018 Ey Global

Reit Etf Definition Structure How To Invest

The Growing Case For Global Reits Neuberger Berman

Real Estate Investment Trust Reits Is A Hybrid Product Between Equity And Fixed Income Which Generates Regular Amp Growing Cash Yields Amp Al Twitter Thread From Mrinal Dhamani Mrinaldhamani Rattibha

What Is Real Estate Investment Trust Reit In India Sbnri

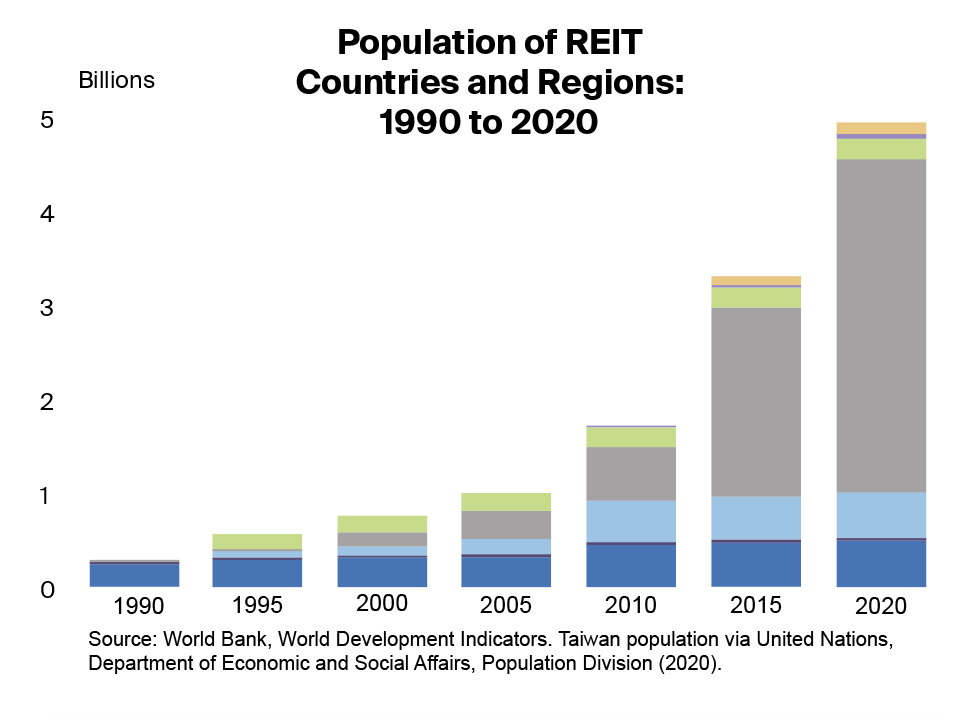

Nareit Study Shows The Growth And Benefits Of Global Reit Adoption Nareit

Reits In India Features Pros Cons Tax Implications

Diversification Benefit And Return Performance Of Reits Using Capm And Fama French Evidence From Turkey Sciencedirect

Bsec Moves For Maiden Real Estate Investment Trust This Year

The Taxman Cometh Reits And Taxes

What Is A Data Center Reit Dcd

Sigrid Zialcita Sigridzialcita Twitter

How To Use Transfer Pricing To Protect Reit Income

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

Long Term Capital Gains Tax Cii Pitches For Reduction In Reits Invits Units Holding Period To One Year The Hindu Businessline

What Are Reit Return Really Fy21 22 Pre Tax Vs Post Tax Returns Of Embassy Brookfield Mindspace Youtube

Union Budget 2015 Government Gives New Tax Benefits For Reits Invits The Economic Times